With General Electric (NYSE:GE) stock up 32% in the last month, it's time to take a pause and question whether it remains a good value or not. To shed some light on this question, let's take a look at each GE industrial segment on an individual basis and then bring them together to see what the company could be worth.

General Electric company

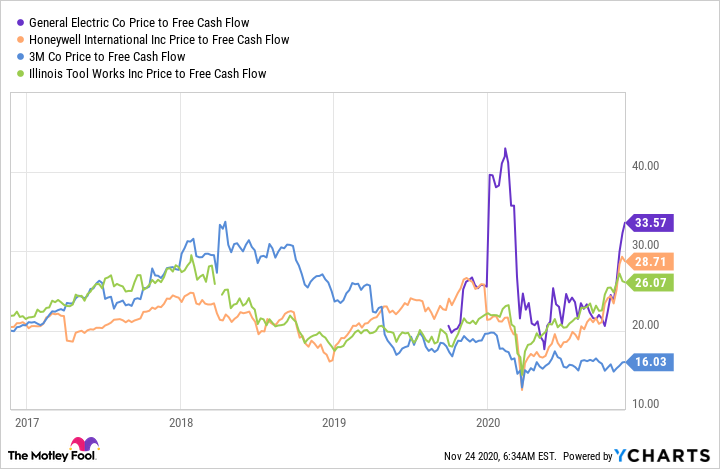

If you are thinking of investing in GE, the first thing you have to accept is that patience is necessary. The fact is, GE won't look anything like a good value on a conventional basis for a few years yet. As a rough rule of thumb, you could take the fair value of a multi-industry industrial stock to be around 20 times its industrial free cash flow (FCF). For reference, FCF is the yearly flow of cash that can be used to pay down debt, initiate buybacks, or pay dividends.

GENERAL ELECTRIC'S EXPOSURE TO COMMERCIAL AVIATION HAS HIT IT HARD IN 2020. IMAGE SOURCE: GETTY IMAGES.

As you can see below, GE isn't anywhere near that figure now. Unfortunately, the coronavirus pandemic hit GE very hard due to its heavy exposure to commercial aerospace. As such, Wall Street analysts are forecasting a cash outflow of $1.4 billion in 2020, and then just $2.4 billion in 2021 and $4 billion in 2022. To put these figures into context, GE's current market cap is $88.2 billion -- meaning it won't trade on 22 times FCF until the end of 2022.

On a superficial level, that's not an attractive valuation. However, in the context of a company in the middle of a long-term ramp up in margins across three of its four businesses, it is a compelling value.

DATA BY YCHARTS

The long-term case for General Electric

The healthcare segment is performing fine and investors can pencil in at least low-single-digit growth in earnings and FCF for the foreseeable future. In other words, you can think of GE Healthcare as already being a mature business that could be valued, on its own, as a business worth 20 times is FCF.

| General Electric Segment | 2019 FCF | Opportunity |

|---|---|---|

| Power | ($1.5 billion) | A low-growth industry, but there is an opportunity to raise the margin to competitor's levels, notably in services, and significantly grow FCF in the coming years |

| Aviation | $4.4 billion | Opportunity to embark on a multi-year recovery in aviation, notably with engine aftermarket sales |

| Healthcare* | $1.2 billion | A low to mid-single-digit growth industry, good ongoing free cash flow |

| Renewable Energy | ($1 billion) | A mid-single-digit growth industry, and an opportunity to raise the margin and FCF generation to competitor levels with onshore wind energy while establishing a position in offshore wind energy |

The interesting thing for GE investors is that there's a lot of catching up to do. For example, GE Renewable Energy actually had a 4.3% segment margin loss in 2019. However, the segment's margin was 0.1% in the recent third quarter, and before the pandemic management believed it would be breakeven in 2021. If GE can generate high-single-digit margins in, say 2024, then earnings could easily be $1.4 billion, representing a $2.06 billion swing in profits from 2019's loss of $666 million.

Adjusted Operating Profit Margin | 2017 | 2018 | 2019 | 2020 Est. | 2021 Est. | 2022 Est. |

|---|---|---|---|---|---|---|

| Siemens Gamesa | 7.1% | 7.6% | 7.1% | (2.5%)* | 4.1% | 7.3% |

| Vestas | 12.4% | 9.5% | 8.3% | 5.9% | 8.5% | 9.2% |

DATA SOURCE: COMPANY PRESENTATIONS, MARKETSCREENER.COM. *ACTUAL FIGURE

A similar argument applies with GE Power and its main rival, Siemens Energy. The German company's guidance is for its gas and power segment's adjusted earnings before interest, tax, and amortization (EBITA) margin to be 0%-2% in 2020 with 3.5%-5.5% in 2021 and reaching 6%-8% in 2023. In common with GE Power, Siemens' power operations have suffered a margin hit in response to a collapse in demand for gas turbines in the last five years.

GE RENEWABLE ENERGY HOPES TO IMPROVE ITS MARGIN TO THAT OF ITS PEERS. IMAGE SOURCE: GETTY IMAGES.

If GE can get back to a mid-single-digit segment margin from the 2.1% in 2019, then GE Power could be looking at $1 billion in segment earnings in 2024-- representing a swing of $600 million from 2019's profit of $386 million.

Finally, GE Aviation is set for a multi-year recovery in revenue/earnings as the commercial aerospace market recovers from the pandemic. It's impossible know when traffic levels will return to 2019 levels, but many commentators are penciling in 2023 with the aftermarket returning to 2019 levels in 2024. As such, GE Aviation will be in the middle of a multi-year recovery at the end of 2022.

In addition to GE Aviation, GE also has exposure to aerospace through GE Capital Aviation Services, or GECAS. The business is the most important part of the finance arm of GE, namely GE Capital. As such, GE would inordinately suffer given an extended downturn in aviation. In addition, GE Capital as been something of a wildcard in recent years in terms of its insurance liabilities. These are added risks worth considering.

Is General Electric a buy?

On balance, and based on analyst forecasts, GE is worth buying. A valuation of 22 times FCF in 2022 is attractive for a business that would be in the middle of a multi-year recovery until, say 2024, when it would then return to a more normal growth path.

However, investors need to be mindful that a lot can change in the economy, and it's going to take time before they see the improvement in the numbers. Nevertheless, on a risk/reward basis GE remains attractively priced.

Where to invest $1,000 right now

Before you consider General Electric Company, you'll want to hear this.

Investing legends and Motley Fool Co-founders David and Tom Gardner just revealed what they believe are the 10 best stocks for investors to buy right now... and General Electric Company wasn't one of them.

The online investing service they've run for nearly two decades, Motley Fool Stock Advisor, has beaten the stock market by over 4X.* And right now, they think there are 10 stocks that are better buys.