Craft brewers aren't going to sit around and cry in their beers about Anheuser-Busch InBev(NYSE:BUD) "diluting" their niche with multiple acquisitions. After watching the megabrewer buy out 10 different craft breweries, they've decided to turn the tables and launch a crowdfunding campaign to raise over $200 billion to purchase the King of Beer.

It's a humorous effort, if not hopeless, given how difficult it would be raising hundreds of billions of dollars from individual investors. As the Take Back Craft website notes, it'll require every man, woman, and child in the U.S. contributing over $653 to reach the goal, or just under $29 if everyone in the world contributed. As of this writing, only $2.7 million has been pledged by more than 8,500 contributors.

An insatiable appetite for craft beer

The success of the craft beer industry over the past two decades -- as mass-brewed beer languished -- drove Anheuser-Busch and other industry giants to focus M&A spending on smaller craft brands. AB InBev kicked it off by purchasing Goose Island back in 2011, before picking up Blue Point Brewing, 10 Barrel Brewing, Elysian, Breckenridge, and more. After buying Wicked Weed this past spring, management now says it's swearing off any additional deals in the space.

But others have stepped in to fill the void. Two years ago, Constellation Brands (NYSE:STZ)bought Ballast Point Brewing, and it recently picked up Funky Buddha. Last year, MillerCoors(NYSE:TAP) bought three craft brewers. Heineken (NASDAQOTH:HEINY) bought Lagunitas in May, and Japan's Sapporo just acquired Anchor Brewing, which was considered the original craft brewer.

The craft beer industry was somewhat hostile to the megabrewer's takeover attempts. Several years ago, they took out ads complaining about the creation of "craft-y", or so-called mass craft beer. And earlier this year, the Brewers Association initiated a new labeling program that will let true craft brewers identify themselves as such on their labels with a logo that says "Independent Craft".

Although it's been argued that people don't care about who brews their beer so long as it tastes good (and there is some merit to the point), it turns out a lot of people actually do want to support brewers who are small and local.

Analysts at UBS surveyed 1,200 beer drinkers and discovered that what despite conventional wisdom suggests, 56% say it's at least somewhat important that craft beer actually be made by a craft brewer.

IMAGE SOURCE: GETTY IMAGES.

David and Goliath

With crowdfunding at just $3 million so far, even the Brewers Association admits its goal "only seems impossible if you really think about it."

The effort is tongue-in-cheek, but it carries with it a sobering message. By buying up so many small brewers, the industry giants are only creating the illusion of choice in craft beer. In reality, the megabrewers use their broad distribution networks to control the space. It's certainly difficult enough for craft brewers to compete against one another without AB InBev, Miller Coors, and Constellation Brands crowding out shelf space.

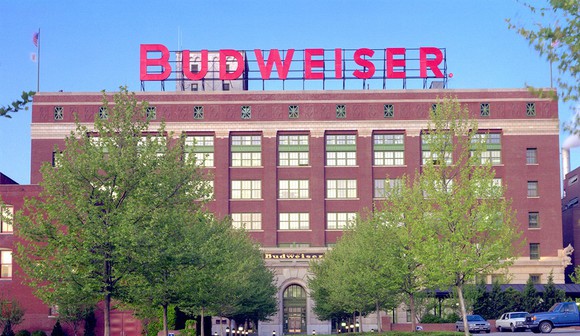

IMAGE SOURCE: ANHEUSER-BUSCH INBEV.

Boston Beer (NYSE:SAM), long the face of the craft beer industry, has itself fallen on hard times as its flagship Samuel Adams brand stumbles. Depletions, or sales to distributors and retailers -- an industry proxy for consumer demand -- are down 7% year to date. And even Constellation's billion-dollar baby, Ballast Point, is struggling to maintain sales growth. The brewer had to write down the carrying value of the brand earlier this year because of negative sales trends.

In reality, the genuine craft beer industry seems as healthy as ever. Over 5,000 breweries operate today, more than at any time in the country's history, and more are coming online every day. These are the brewers the majority of beer drinkers identified as wanting to support.

By putting an astronomical price tag on maintaining independence, what may be the Brewers Association's best marketing effort to date highlights the staggering odds the craft beer industry faces.

Newly updated! 10 stocks we like better than Anheuser-Busch InBev NVWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

On October 13, David and Tom revealed what they believe are the ten best stocks for investors to buy right now… and Anheuser-Busch InBev NV wasn't one of them! That's right -- they think these 10 stocks are even better buys.