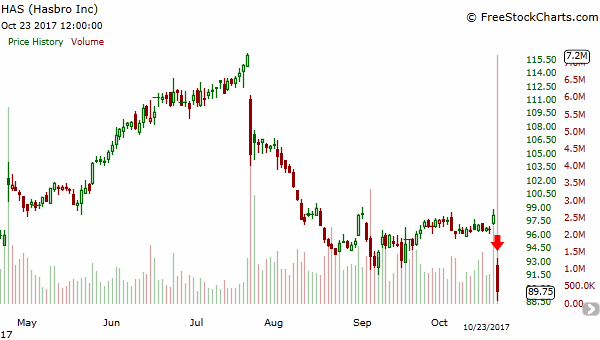

With the financial results released for the third quarter, and the decline in stock price, I look to re-evaluate my long position in Hasbro (NASDAQ: HAS), and provide my perspective and takeaways. Last month, I initiated a position in Hasbro on the previous pullback in stock price. At that time, the stock had already gone through a -20% decline, and in my opinion, the stock was trading at a discount to its fair value with reasonable upside. After re-evaluating investor concerns and the recent financial results, I still feel comfortable with my long position. I provide a brief overview of my takeaways from the financial results in the sections below.

(Source: FreeStockCharts)

High Expectations for Fourth Quarter and Toy “R” US Bankruptcy

Management's updated guidance for fourth quarter results was the perceived cause of the current selloff for the stock, a decline of over 8%. The company otherwise had a solid third quarter, exceeding expectations for both revenue and earnings per share. The company's revenue and earnings per share were $1.79 billion and $2.09, respectively, in comparison to analyst consensus estimates of $1.78 billion and $1.94, respectively.